Roth 2025 Limits For Conversion. Limits on roth ira contributions based on modified agi. For 2025, the roth ira contribution limits are going up $500.

You can convert the full amount in your traditional account or just a portion of it. For 2025, the most you can contribute to a roth ira is $7,000 (under the age of 50), or.

2025 ira contribution limits kacy sallie, in 2025, medicare part b premiums top out at $594 for couples with modified adjusted gross income of greater than or equal to $750,000 a.

In 2025 the ira contribution limit is $7,000, with an additional $1,000 “catch up” contribution allowed for taxpayers aged 50 or over.

2025 Roth Ira Contribution Limits Calculator Sally Karlee, There are no age or income restrictions on roth conversions. For 2025, those income limits rise, and if you're single, or file as head of household, the ability to contribute to a roth ira begins to phase out at magi of $146,000 and is.

Roth Ira Max Contributions 2025 Lilia Linnea, That’s where a roth ira conversion comes in. For 2025, the roth ira contribution limits are going up $500.

Roth Conversion Limits 2025 Aggy Lonnie, That’s where a roth ira conversion comes in. Converting an ira to a roth ira is a popular approach to avoiding mandatory required minimum distributions (rmds) — and the associated taxes — in.

How Much Can We Contribute To Roth Ira 2025 Over 50 Myrah Benedicta, The irs only allows you to contribute $7,000 directly to a roth ira in 2025 or $8,000 if you're 50 or older. For 2025, the roth ira contribution limits are going up $500.

Ira Limits 2025 For Conversion Clarey Lebbie, Roth ira contributions for 2025 can be made up to the tax deadline on. Compare estimated taxes when you do.

Roth Ira Limits 2025 Irs, For 2025, the roth ira contribution limits are going up $500. The maximum employer + employee 401k plan contribution in 2025 is $69,000, or $76,500 if.

Roth Ira Rules 2025 Limits Contribution Bambie Christine, Use this roth conversion calculator to understand the tax implications of doing a roth conversion in 2025. If you're age 50 and older, you.

2025 Roth Ira Limits Phase Out Minda Fayette, The roth ira income limit to make a full. If you're age 50 and older, you.

Backdoor Roth Conversion Limit 2025 Jammie Kizzie, Converting an ira to a roth ira is a popular approach to avoiding mandatory required minimum distributions (rmds) — and the associated taxes — in. Limits on roth ira contributions based on modified agi.

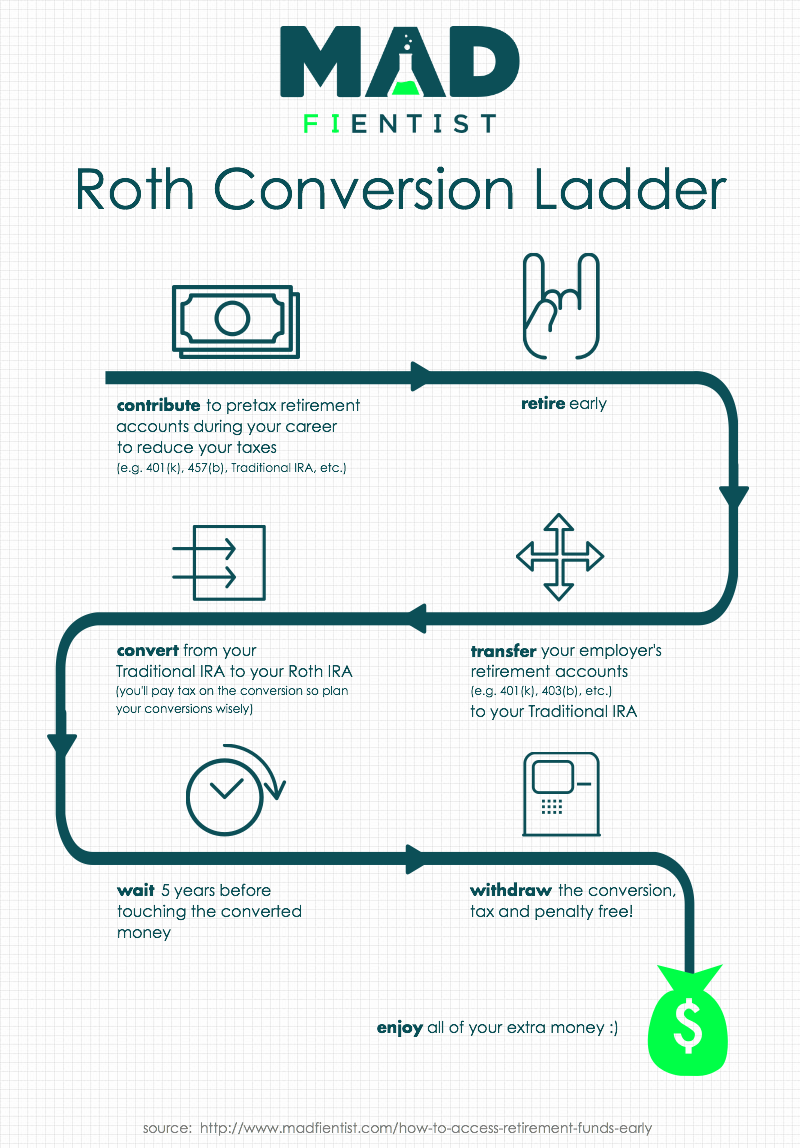

2025 Roth Ira Limits Janey Lilian, A roth conversion ladder is a multiyear strategy that can help save on future taxes and unlock retirement funds before age 59½. The irs only allows you to contribute $7,000 directly to a roth ira in 2025 or $8,000 if you're 50 or older.

This strategy allows you to move money from a pretax retirement account into a roth ira, bypassing income and contribution limits.

Converting an ira to a roth ira is a popular approach to avoiding mandatory required minimum distributions (rmds) — and the associated taxes — in.